MONROVIA, LIBERIA – The House of Representatives Committee on Ways, Means & Finance, Judiciary, Public Accounts, and Expenditure has been tasked with reviewing a proposal to modify Chapter 10 of the Liberia Revenue Code (LRC). The committee plans to present its findings to the full assembly on Thursday, April 25, 2024.

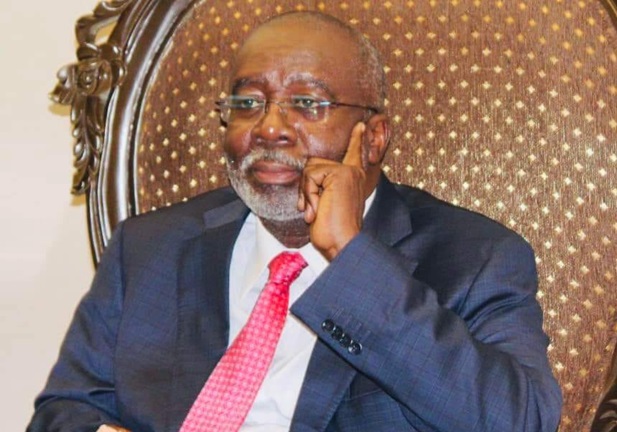

The House’s decision was prompted by a request from President Joseph N. Boakai, Sr., who called for legislative review of the suggested changes. During the 7th Day of the Extraordinary Session of the 55th Legislature on Tuesday, April 23, 2024, President Boakai emphasized the advantages of implementing Value-Added Tax (VAT). He described VAT as a fair tax system with broad coverage, minimal exceptions, and a focus on encouraging compliance and transparency.

President Boakai explained, “The Government of Liberia plans to leverage VAT to improve the country’s tax framework, boost compliance, and increase revenue for national development. VAT implementation is expected to generate additional revenue and narrow the existing fiscal deficit.”

He also highlighted Liberia’s unique position as the only ECOWAS member that has not yet adopted VAT, despite agreeing to do so in 2009 under a pact with the ECOWAS Commission. Introducing VAT aims to overcome the limitations of the current Goods and Services Tax (GST) system and improve domestic revenue collection.

President Boakai stressed the inclusive approach taken during the drafting of the amendment. The VAT Technical Working Group collaborated with a range of stakeholders, including local leaders, development partners, government bodies, civil society groups, and the National Legislature. Feedback sessions were held with local officials from various counties to incorporate their insights into the proposal.

Furthermore, with backing from USAID, several discussions were organized with business leaders. A special session on VAT implementation took place in Gbarnga in 2021, and members of the House’s Ways, Means, and Finance Committee participated in a VAT study trip to Rwanda in 2022.

The suggested changes to the Liberia Revenue Code signify a significant move towards updating the country’s tax structure, aligning with regional integration efforts, and boosting revenue for national growth. The House of Representatives’ Committee review is pivotal in determining the direction of Liberia’s tax regulations and financial planning.