MONROVIA, LIBERIA – A potential corruption scandal has surfaced at the Central Bank of Liberia (CBL), involving the disbursement of US$730,000.00 for the July 26 celebrations in 2019 during the tenure of former Governor Nathaniel Patray. This revelation has raised significant concerns about the financial practices at the CBL under the Coalition for Democratic Change (CDC) government led by President George Weah.

The issue came to light through an investigation reported by Frontpage Africa. The report alleged that Madam Nyemadi Pearson, the Deputy CBL Governor for Operations, was responsible for disbursing the funds without appropriate authorization. This claim has brought to the forefront questions about the integrity and transparency of financial operations within the bank.

Further investigation into the matter revealed that the CBL disbursements were made to various entities, including the Liberia National Police (LNP), the National Security Agency (NSA), and the Ministry of State for Presidential Affairs. The involvement of these entities has added another layer of complexity to the unfolding scandal.

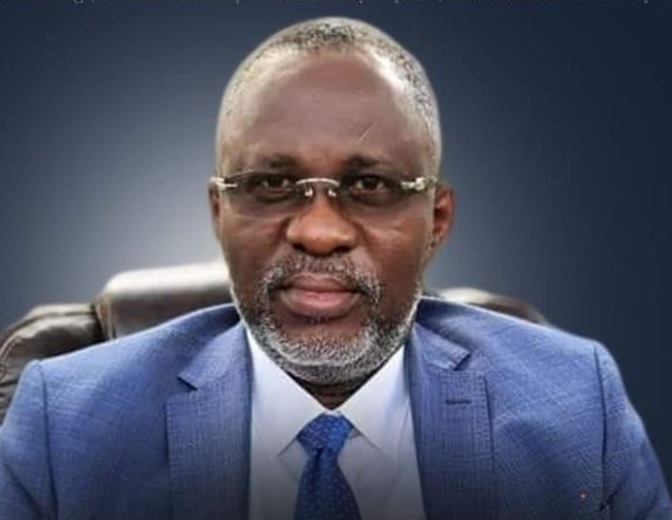

A critical piece of evidence emerged from a CBL press release dated October 25, 2019, where Governor Patray announced his resignation. This timing has led to questions about the chain of command and the decision-making process within the CBL at the time. The key issue under scrutiny is whether the Deputy Governor had the authority to disburse such a significant amount without the explicit approval of the Governor.

To gain a clearer understanding of the situation, it is important to examine the internal processes and protocols at the CBL. Typically, the disbursement of funds requires a series of approvals and adherence to legal procedures. Any deviation from these processes could indicate potential misconduct or gaps in the bank’s governance framework.

Despite the serious allegations, one must critically examine the professional record and reputation of Madam Pearson. While she is known for her integrity and dedication to her role, it is imperative to scrutinize whether her actions align with the ethical standards expected of her position. Evaluating Pearson’s actions within the context of her responsibilities and the directives she received from her superiors may reveal potential lapses in judgment or adherence to protocol.

The story has sparked widespread discussion about the need for accountability and transparency within Liberia’s financial institutions. It underscores the importance of robust oversight mechanisms to prevent misuse of public funds and to ensure that all actions align with the legal and ethical standards.

As the investigation continues, it is crucial to ensure that all relevant facts are thoroughly examined. The outcome of this inquiry will have significant implications for the CBL and the broader efforts to combat corruption and promote good governance in Liberia.

This developing story highlights the challenges faced by financial institutions in maintaining transparency and accountability, and it serves as a reminder of the ongoing need for vigilant oversight to safeguard public resources.