Liberia is set to hand over control of nearly 10% of its total land mass to a United Arab Emirates-based firm in a massive million-hectare carbon credit deal that’s drawing fire from local and international environmental groups. According to a leaked draft of the contract, the deal could override the customary land rights of communities living in vast swaths of the country’s forests, potentially violating a number of Liberian laws.

If signed, the deal would create protected forests for the purpose of generating carbon credits, which could then either be sold on voluntary markets or traded bilaterally between Liberia and other governments looking to meet their emissions targets.

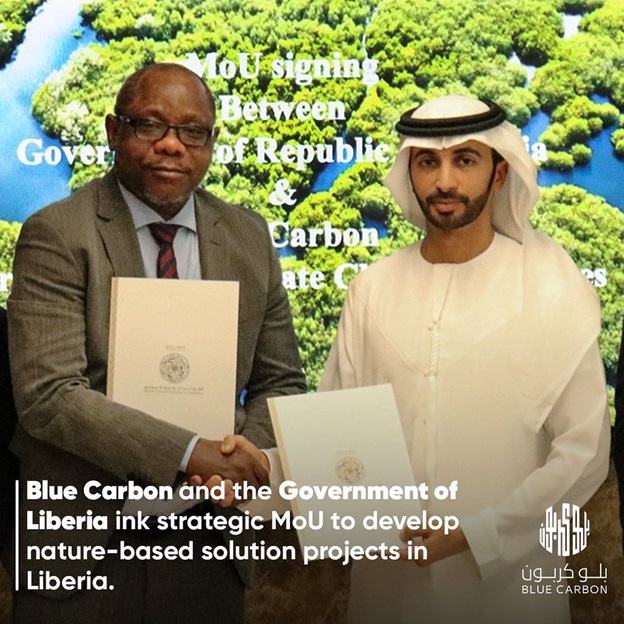

Development and marketing of those credits would be carried out by Blue Carbon, a firm headquartered in Dubai and launched last October by Ahmed Dalmook Al Maktoum, the youngest member of Dubai’s royal family. Blue Carbon is part of Ahmed’s “private office,” which, along with his Ameri Group conglomerate is a major investor in energy projects across Africa and the Middle East, including oil and gas.

On its website, Blue Carbon says it was “formed to create environmental assets, nature-based solutions, and register carbon removal projects using modern methodologies.” In less than a year, the firm has also inked high-profile MOUs with Tanzania and Zambia to develop carbon credit-generating conservation projects.

The deal with the Liberian government would give it near-total control of the country’s remaining intact rainforests for the next 30 years.

In a public statement, Liberia’s Independent Forest Monitoring Coordinating Mechanism (IFMCM), a group of seven environmental and community rights organizations, acknowledged that the deal could help protect threatened forests. But it said a blanket transfer of land rights to Blue Carbon in the project areas would violate Liberia’s 2018 Land Rights Law, a hard-fought reform that granted communities ownership of their customary land.

“Claiming the legal rights to market the forest carbon has clear implications for property rights, as it affects the communities’ rights to determine how their land is used,” the group wrote.

The draft contract, which Mongabay has seen, obliges Blue Carbon and the Liberian government to “apply best efforts” to undertake free, prior and informed consent (FPIC) negotiations with communities in the project areas within three months. But there’s scant detail on how those negotiations, which would need to involve hundreds of thousands of people on land covering 1 million hectares (2.5 million acres), could be completed in such a short time.

It also asserts that forest land granted to Blue Carbon is free of “encumbrances” — or impediments to development — in a promise that the Liberian government is likely to have a hard time keeping. In previous years, major contracts for land signed with foreign investors to develop plantations ran into significant resistance from communities who fought yearslong battles to protect their claim.

“There will need to be consultations that will happen in those communities,” said Jonathan Yiah, a forest governance researcher at Liberia’s Sustainable Development Institute. “There is no community in Liberia that is free of encumbrances.”

One of Liberia’s opposition parties, the Liberian People’s Party, has called for negotiations between the government and Blue Carbon to be suspended until communities who will be impacted by the deal are consulted. And in a statement, 14 environmental organizations from Europe, China and the U.S. sharply criticized the deal, saying it was “unclear what the benefits for Liberia and its communities will be.

According to the Liberian environmental news publication The Daylight, the country’s top forestry official made an irregular request for Blue Carbon to be able to bypass a competitive bidding process that would normally be required by law.

Blue Carbon did not respond to repeated requests for comment by Mongabay.

The potential deal comes amid rising deforestation rates in Liberia, which, according to the World Resources Institute, was the 10th-highest rate of increase of any country between 2020 and 2022. Recent years have also seen shaky application of the rule of law in Liberia’s forestry sector. In March, officials who refused to issue an export permit for illegally felled logs were threatened with jail time by a judge, and The Daylight reported that other permits have been issued outside of a chain-of-custody tracking system required by forestry reform laws.

Conservation efforts inside community-managed forests in Liberia have been difficult to sustain, with some communities, under the intense pressures of poverty, deciding that logging and mining companies can offer them a better deal. Supporters of carbon credit markets say they could be a way to channel funds toward forest protection in countries like Liberia, providing a revenue stream to governments and communities aside from destructive resource extraction.

The Blue Carbon contract is being negotiated as the UAE prepares to host November’s COP28 climate conference, in a role that’s been criticized by environmentalists due to the importance of oil production to the small country’s economy. Rules governing carbon markets are expected to be a top-line item for debate at the conference, including what kind of human rights protections should be required in offsets and how their “additionality” — what kind of carbon savings they actually generate — should be measured.

The EU has stated it will oppose “avoided” deforestation as a valid measurement of an offset’s carbon savings, since there’s no way to measure a hypothetical scenario. Blue Carbon’s draft contract says it will meet REDD+ additionality standards, but the areas included in the concession are currently under very different forms of land use. Abandoned logging areas and community-managed forests would be handed over to the firm, but so would long-standing nature reserves like Sapo National Park. Examples of projects to be developed in those areas are listed as “reforestation, forest conservation, sustainable land management, and other carbon removal initiatives.”

How pre-existing nature reserves could be used to offset carbon emissions elsewhere, and what methodologies will be used to assess the additionality of the credits, is unclear.

“Additionality is a complex thing to assess, but I think if it’s already a conservation or protected area where it’s not permitted to log, that does raise significant doubts about the additionality case there,” said Jonathan Crook, a policy expert with Carbon Market Watch.

The draft contract also doesn’t make clear whether credits generated by Blue Carbon will be sold in “voluntary” markets, where they can be purchased by corporations and other private actors, or through direct bilateral deals with governments like the UAE looking to meet their national emissions targets. While standards that currently cover voluntary market credits are often criticized, there are even fewer rules covering bilateral deals.

Kate Dooley, a research fellow at the University of Melbourne’s Climate and Energy College, told Mongabay she worries credits sold by Blue Carbon directly to governments would have weak monitoring and verification requirements.

“There doesn’t have to be a third party involved or third-party oversight,” she said. “And that’s mentioned a fair bit in the contract, that these deals between Liberia and another government, which perhaps would be the UAE, can agree on what it is they want to trade and what the rules are.”

As the middleman for the transactions, Blue Carbon would tuck away a nice profit. The draft contract says the company will pay Liberia a 10% royalty on the gross proceeds of carbon credit sales, and won’t have to make any additional payments until it recoups its upfront investment. Afterward, it would pay the Liberian government a 30% share of any profits it makes from selling the credits, according to the draft contract. The firm is also exempted from paying any taxes for 10 years.

Around half of the money paid to Liberia’s government would be earmarked for communities inside credit-generating areas. On paper, it could be a sizeable payout, but the contract says decisions on how to spend those funds would be made by five-person committees comprised of two community members, two people appointed by Blue Carbon, and one government official. The communities themselves could be outvoted in deciding how money ostensibly under their control is to be spent.

Similar revenue-sharing models have not delivered as much as they promised in Liberia. The government still owes nearly $7 million to communities entitled to logging payments stipulated by forestry reform laws.

Liberia’s recent history suggests problems could follow if people who have to comply with land-use restrictions inside Blue Carbon’s project areas don’t feel adequately compensated.

“Communities should be able to know that they will indeed get physical cash to help with some of their needs, but once they are promised and nothing happens it will be difficult for them to cooperate,” said Yiah from the Sustainable Development Institute.

The final deal between Blue Carbon and Liberia may differ from the contract draft seen by Mongabay. But it could be hard to tell what’s changed — the draft includes a confidentiality clause, meaning it would not be open to public scrutiny.

“We’re just looking at a contract, and we don’t know what the intentions are, but nothing about it looks good. Nothing,” Dooley said. “I’ve never seen any proposal for that kind of deal before on this scale.” Source: news.mongabay.com